Your cart is empty

How To Get Insurance To Pay For Your Bariatric Surgery

Insurance Coverage for Bariatric Surgery

Navigating the financial landscape of bariatric surgery can often feel like an uphill battle. With costs that can range anywhere from $15,000 to a staggering $50,000, insurance coverage becomes a critical lifeline for most patients. But fear not, we're here to help illuminate the path and break down the process, ensuring your journey towards a healthier you is as smooth as possible.

Checking Your Policy

Before you set your heart on bariatric surgery, it's crucial to take a deep dive into your insurance policy. Many insurance providers do cover weight loss surgery, but it often comes with certain conditions attached. You can either pore over your policy documents or, for a more straightforward approach, get in touch with your insurance company directly. Speaking with an agent can help you navigate the labyrinth of fine print of your policy and clarify what's covered and what's not. Remember, knowledge is power, and understanding your policy is the first step towards securing coverage.

Requirements for Coverage

Insurance companies aren't known for handing out coverage approvals like candy. They typically have a set of criteria that need to be met before they give the green light for bariatric surgery coverage. These may include:

- A body mass index (BMI) of 40 or higher, or a BMI of 35 or higher coupled with at least one obesity-related health condition (e.g., type 2 diabetes, high blood pressure, sleep apnea).

- A documented history of unsuccessful attempts at non-surgical weight loss through diet and exercise.

- Completion of a medically supervised weight loss program.

- A psychological evaluation to ensure the patient is mentally prepared for the surgery and the subsequent lifestyle changes.

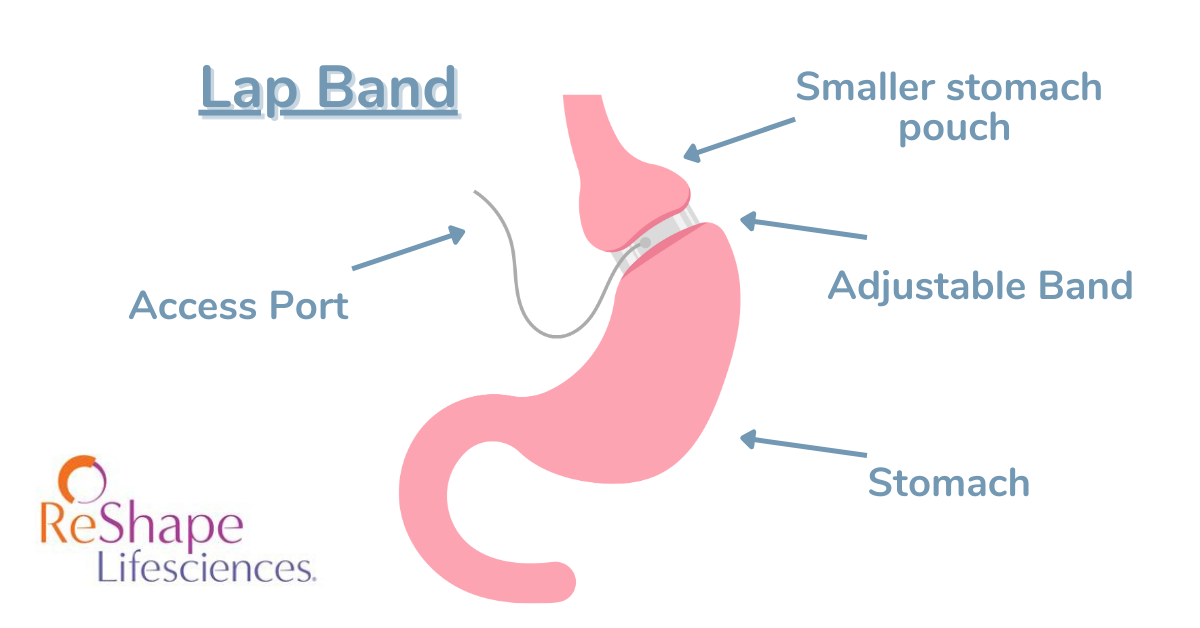

Government programs like Medicare and Medicaid also cover some bariatric procedures, including gastric bypass surgery and laparoscopic banding surgery, but only for patients who meet these criteria. They may also require participation in a supervised medical weight management program before they approve the surgery.

Out-of-Pocket Expenses

Even if your insurance rolls out the red carpet for your bariatric surgery, you may still encounter out-of-pocket expenses. These can take the form of deductibles, copayments, and coinsurance. It's essential to factor these costs into your budget and fully understand your financial responsibility before you proceed with the surgery. Remember, forewarned is forearmed, and a comprehensive understanding of potential costs can help you avoid any unpleasant financial surprises down the line.

Steps to Get Insurance to Pay for Bariatric Surgery

Step 1: Consultation with a Bariatric Surgeon

The first step in your journey towards securing insurance coverage for bariatric surgery is to consult with a qualified bariatric surgeon within your plan network. This professional will evaluate your situation, discuss the available surgical options, and help you determine if you're a suitable candidate for the procedure. It's crucial to choose a surgeon who not only has a wealth of experience in performing bariatric surgeries but also has a proven track record in dealing with insurance companies. They can guide you through the steps and hurdles to secure coverage, making the process less daunting.

Step 2: Medical Necessity Documentation

To convince your insurance company to cover your bariatric surgery, you'll need to prove that the procedure is not just a whim, but a medical necessity. This typically involves gathering a comprehensive set of documentation from your primary care physician, the bariatric surgeon, and possibly other medical professionals. This documentation should demonstrate that you've met the required criteria set by the insurance company. It may include records of your weight loss history, BMI measurements, and proof of participation in a medically supervised weight loss program. Remember, every piece of evidence strengthens your case.

Step 3: Preparing a Preauthorization Request

Once you've gathered all the necessary documentation, it's time for your bariatric surgeon or their office to prepare a preauthorization request. This request, which will be submitted to your insurance company, should include a detailed treatment plan along with all the supporting documentation. The insurance company will then review the request and make a decision to either approve or deny coverage. This process can take several weeks, so patience is key. Be prepared for possible delays and remember, good things come to those who wait.

Step 4: Appealing a Denied Claim

If your insurance company denies coverage for your bariatric surgery, don't despair. Many denials can be successfully appealed with additional information or clarification. Collaborate closely with your bariatric surgeon and their office to gather any additional documentation needed and submit a well-crafted appeal letter. Keep in mind that the appeals process can be lengthy, so persistence is your best friend. Regularly follow up with your insurance company and remember, the squeaky wheel gets the grease.

Alternatives to Insurance Coverage

Self-Pay Options

If your insurance does not cover bariatric surgery, or if you don't have insurance, self-pay options are available. Some bariatric surgery centers offer package deals for self-pay patients that include all the necessary preoperative tests, the surgery itself, and postoperative care. Be sure to research and compare prices among different providers to find the best option for you.

Medical Loans

Another alternative to insurance coverage is taking out a medical loan to finance your bariatric surgery. Many financial institutions offer loans specifically designed for medical procedures, with competitive interest rates and flexible repayment terms. Make sure to research different lenders and compare loan offers to find the best fit for your financial situation.

FAQs

Do all insurance plans cover bariatric surgery?

How long does it take to get insurance approval for bariatric surgery?

What if my insurance company denies coverage for bariatric surgery?

Can I get bariatric surgery if I don't have insurance?

Are there any additional costs associated with bariatric surgery that I should be aware of?

What types of bariatric surgeries do PPO insurance providers cover?

Is bariatric surgery covered by insurance?

What are the BMI requirements for insurance coverage of bariatric surgery?

What medical conditions are required by insurance companies for bariatric surgery coverage?

What evaluations are mandatory for all insurance plans before bariatric surgery?

Aside from the cost of the surgery itself, there may be additional expenses, such as preoperative tests, postoperative care, nutritional supplements, and potential complications that may require further treatment. It's important to discuss these potential costs with your bariatric surgeon and prepare a comprehensive budget to ensure you're financially prepared for the entire process.

Author: Allison Eisenberg Allison is a certified nutritionist and author with over 15 years of experience writing in the health and weight loss industry. She is passionate about helping people achieve their goals through proper nutrition and exercise. As a certified nutritionist, Allison has worked with clients from all walks of life and helped them make positive changes to their diet and lifestyle. |

Reviewed By: Dr. K. Huffman Kevin D. Huffman, D.O. is a board-certified bariatric physician who has dedicated his career to treating obesity. With over 10,000 patients under his care, he has become a respected authority in the field of bariatric medicine. Dr. Huffman has trained and mentored hundreds of healthcare providers and is widely recognized as a national leader in the field. |

Bariatric Guides & Information

More Info

Customer Favorites

- Choosing a selection results in a full page refresh.